Allies for Every Child and nearly 300 other anti-poverty organizations recently signed a letter by the First Focus Campaign for Children urging Congress to reinstate the enhanced Child Tax Credit and Earned Income Tax Credit. From July–December 2021, these policy improvements had incredibly positive impacts on children and families which should be made permanent. The numbers speak for themselves:

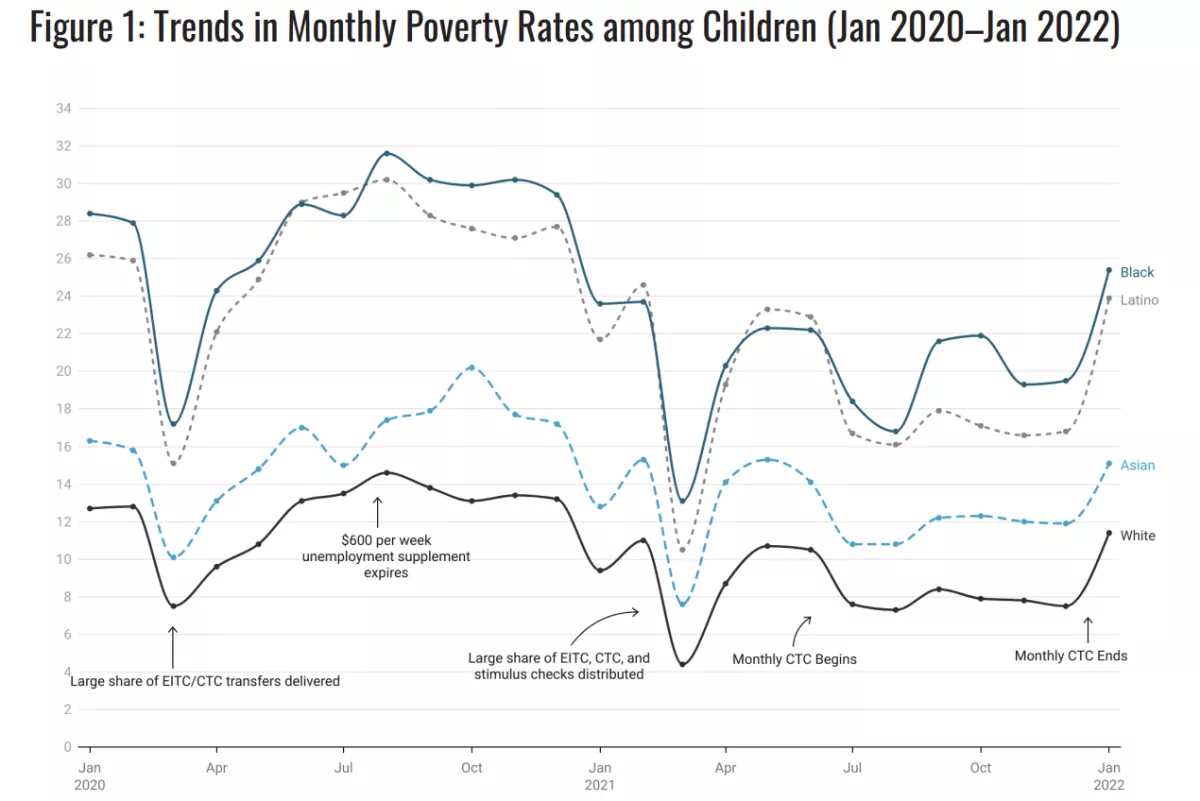

- Last year, the expanded Child Tax Credit cut the child poverty rate nearly in half and lifted millions of children out of poverty—all in a period of just six months. When it ended in January 2022, 4 million children fell back into poverty and food insecurity spiked by 25% for households with children.

- Child Tax Credit funds are overwhelmingly spent on families’ basic needs: food, rent/mortgage and utilities, school expenses, and childcare.

- Poverty itself hinders child development. Earlier this year, results from the Baby’s First Years study showed that for low-income households, infants whose mothers received more money had more brain activity associated with stronger cognitive development.

- Reducing child poverty reduces child maltreatment. A recent study in the American Academy of Pediatrics found an immediate reduction in child maltreatment rates tied to the expanded Child Tax Credit and Earned Income Tax Credit.

Click here for more information and to read the full letter.